Why is it important to focus on customer experience?

According to global research, global banks lose 20% of their customers, or 1 in 5 customers, due to poor customer experience (Source:

Few banks understand the underlying motivations of a particular customer to purchase a particular product, and low satisfaction levels contribute to consumers signing up for financial services products from other providers.

Regardless of age, customers are about 2.5 times more likely to purchase bank products embedded in non-bank channels if the product is managed in partnership with a bank.

Customer engagement has long ceased to be a top priority for retail or marketing alone, for example. Many companies, practically all businesses, and even more so banks, are trying to do everything to make customer interaction comfortable. Firstly, this is promising, and secondly, customers now primarily pay attention to the convenience of a financial or banking application, its interface and functionality. The customer-oriented approach allows the banking and fintech sector to grow and constantly develop, inventing new opportunities for interaction with customers.

What helps you successfully focus on the customer experience?

Based on my many years of experience in developing products for the fintech sector, I will highlight the following components:

— Real-time data analysis

Analyzing data in real time plays a big role. It is the process of collecting, processing and analyzing data as it arrives, without delay or waiting, which plays a big role in today's world, because information is constantly changing or being updated. You can discover hidden patterns or some trends that will help you in future work. Data can be visualized, which is a definite plus.

What kind of customer data is available? Geographic data, demographic data, data about what platform he uses to use your app, how much time he spent, etc. All this helps the team to make informed decisions in further development.

In addition, getting data quickly allows you to react to and fix any processes that aren't working faster.

What does real-time data analysis look like?

— Adaptive personalization

Personalization and adaptive interfaces are one of the key components of success when working with customers. Personalization is good because the customer can choose the element that meets their expectations. The development of personalized elements should be based on audience analysis and their needs.

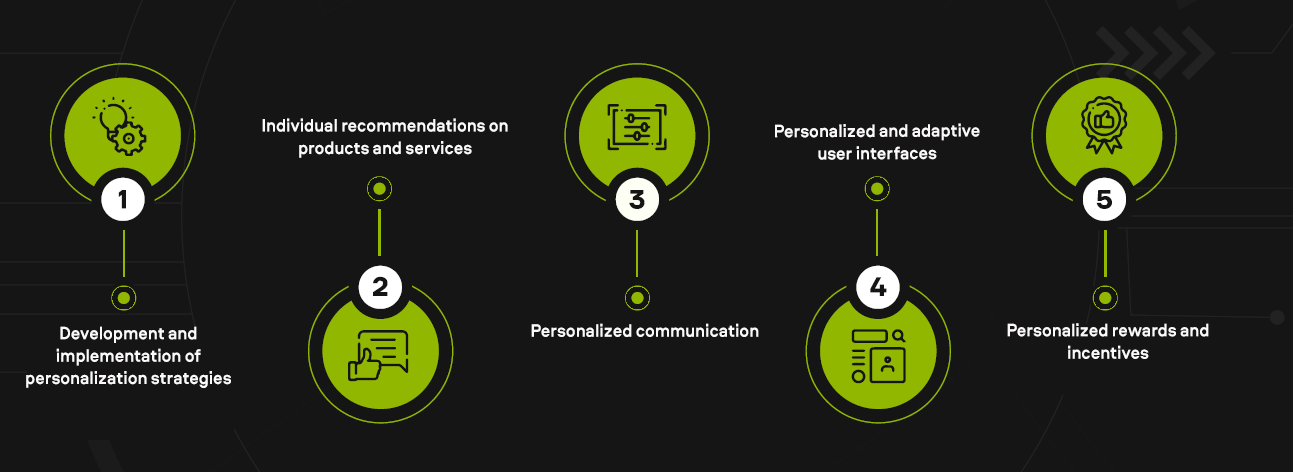

Adaptive personalization consists of the following elements:

- Development and implementation of personalization strategies;

2) Individual recommendations on products and services;

3) Personalized communication;

4) Personalized and adaptive user interfaces;

5) Personalized rewards and incentives.

— Customer communication management

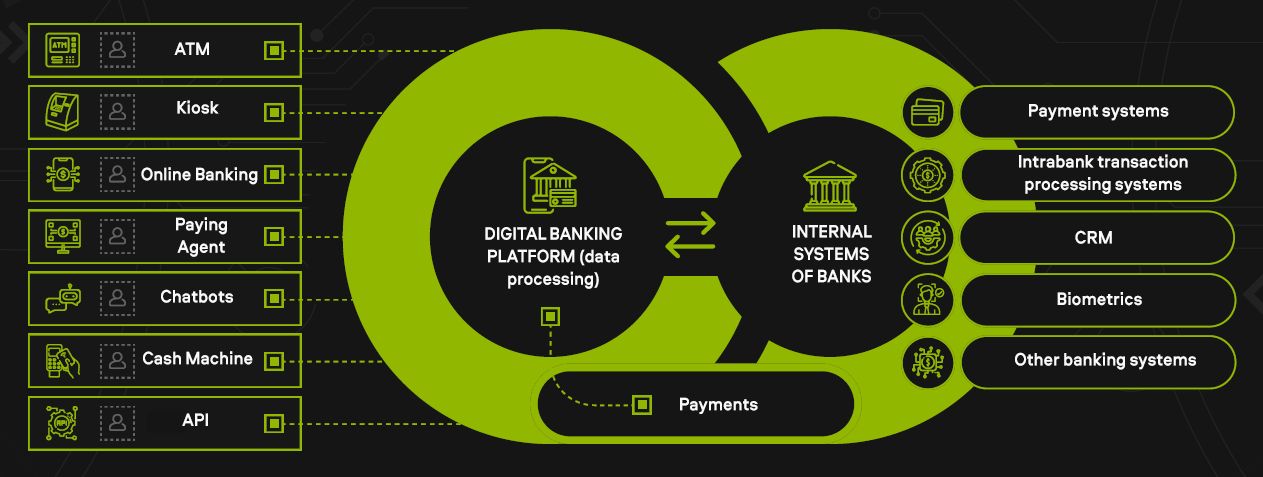

Includes the following channels: social networks and media, messengers and e-mail; intrabank transaction processing systems; other information systems; printed documents; chatbots; online banking; call center automation system; archives; recommendation systems.

Communication with the customer through various channels also plays a big role. It is not acceptable that there is no communication at all. It will play a negative role on your reputation and also deprive you of customer loyalty.

It is important to communicate with the customer, if only because through this communication you learn about the problems and needs of your customers.

— Training and development of staff and / or AI models

The training process helps to acquire new skills and knowledge, as well as to improve existing behaviors. Synergetic development allows increasing productivity and achieve success in banking business through continuous development of skills, generation of new offers and creation of unique experience. The learning process of AI models needs to be continuous, due to the rapidly changing landscape of AI technologies.

— Customer data integration

Customer data is the key to understanding your customers. The data collected can be easily shared with team members, sales and marketing, customer service and, directly, with the executive. By integrating the data, you can get an improved view of your customers to understand them more deeply.

Key Benefits:

To summarize, we would like to mention the following benefits that you get by incorporating technology in this field:

— Increased customer satisfaction;

— Increased customer loyalty;

— Increase in average revenue per customer;

— Increased cross-selling;

— Increased customer retention rate;

— Increase conversion rate.

Utilizing new technologies and staying on top of trends will allow you to take a step forward and set yourself apart from the competition.