It can appear that the world at large is facing a litany of irresolvable issues. Cost of living crises, natural disasters, 40-year inflation highs, huge interest rates, unaffordable rent, the Ukraine war, AI-based employment fears, privacy intrusions, viruses, increasing disease rates, declining social security funds, online censorship, and more.

Yet all of this can be easily simplified into ONE, critical issue: FINANCE. It is through finance that the government and other actors are empowered to make (secret) decisions that are clearly detrimental to those who were fooled into supporting them. Money printing is the source of problems, and printed money is mainly used to buy government treasury bonds, propping up a fraudulent system.

Closely tied in with financial control are KYC procedures, which have proven increasingly invasive and with very little justification. There is no intrinsic reason that sensitive information should be uploaded just for making payments, as this treats people like criminals before any suggestion of wrongdoing. Bitcoin swiftly addresses all of this.

A Brief BTC History

On the Bitcoin Genesis Block were imprinted the words “The Times 03/Jan/2009. Chancellor on brink of second bailout for banks.”. This was a clear reference to the fact that Bitcoin was needed as an alternative to the fiat system. Satoshi Nakamoto laid the groundwork for an ongoing financial revolution with a very coherent message.

Since 2009, little has changed. If anything, the use case for Bitcoin is even more relevant, and central banks have increased their powers. We are still in a position where we need a globally recognized alternative to printed fiat money to help world citizens. I previously wrote about the importance of a global constitution and one world nation, which is the only viable path forward.

In the meantime, the MSM spent a solid 12+ years making up false narratives about Bitcoin. They said it was a Ponzi scheme. They said it used up too much energy. They said it would die off within a few years. They said it was used to launder money by ‘terrorists’, an often used and ill-defined term. And they never retracted a single one of their statements.

They consistently made such statements while propping up a system with remarkable similarities to a Ponzi scheme, which is used to launch wars and surveillance operations, through a highly fraudulent banking system that has a proven track record of billion-dollar money laundering.

Why Bitcoin For Planetary Sovereignty?

Aside from attacks that were designed specifically to discredit Bitcoin on false premises, there were, at one time, legitimate concerns. Many cited the fact that Bitcoin’s PoW consensus mechanism was slow, high-cost, and inefficient. Yet all these concerns have been dealt with through numerous L2s such as Rootstock, Stacks, and Lightning Network.

|

Rootstock |

Stacks |

Lightning Network |

|

|---|---|---|---|

|

EVM Compatible |

Yes |

No |

No |

|

Micro Payments |

Yes |

Yes |

Yes |

|

Type |

Ethereum Sidechain |

Independent Blockchain |

State Channel |

|

Mining |

Merged Mining |

PoX |

NA |

|

Native Token |

RBTC |

STX |

NA |

With the possible exception of Monero, Bitcoin is the only cryptocurrency that is truly decentralized in terms of its servers and its founders. Nobody knows who founded Bitcoin and there has even been a server launched into outer space. It has the highest adoption rates and is the most well-known. Of course, it also has the largest market cap and trade volume.

Bitcoin is one of the few crypto movements that can be said to be purely grassroots and people-powered, with no initial investment, no marketing, and no vested interests. It’s why world governments and central banks hate it so much - there are no founders or investors to harass and target. It’s a truly anti-fragile technology that gets stronger the more it is attacked.

Bitcoin Adoption Levels

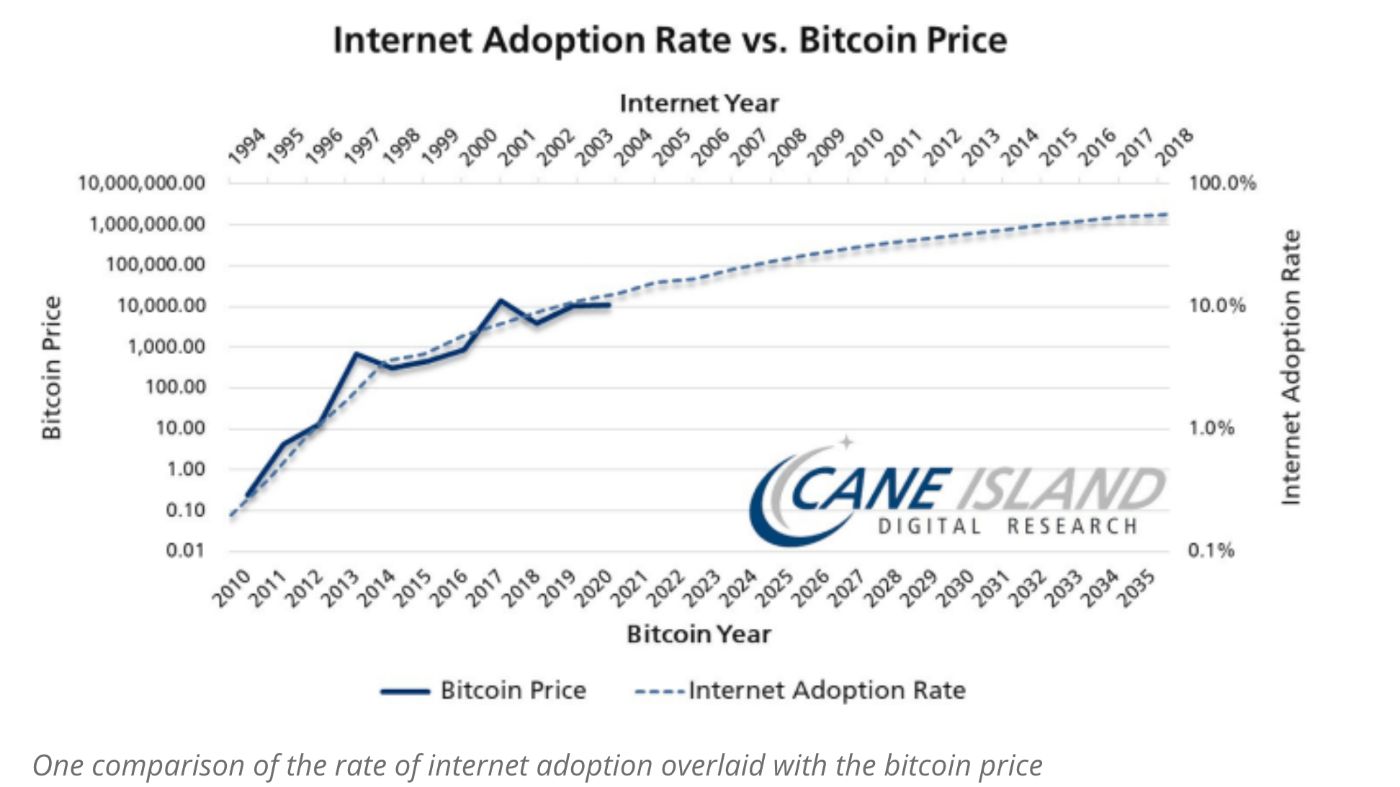

Bitcoin adoption levels are through the roof and have been helped hugely by irresponsible government spending, lockdowns, privacy intrusions, and frustrating social policies. It is becoming popular both in countries with large numbers of unbanked as well as in developed countries with draconian regulatory procedures. Remember, we are still in the early days of Bitcoin adoption and it has much more room for growth.

The globe at large is slowly, if reluctantly, waking up to the fact that fiat-based governments act in a way that is indistinguishable from the threats they say they are protecting us from. Thankfully, this trend of alertness is accelerating and pushing people towards Bitcoin. The following are some inspiring adoption facts relevant to Bitcoin:

- The government of El Salvador has adopted

Bitcoin as a legal tender and made huge profits doing so, despite much criticism. The Central African Republic has done the same.

-

Small towns in South Africa have

integrated Bitcoin as an accepted means of payment. Other areas include Bitcoin Beach in El Salvador. -

Special Economic Zones (SEVs) such as

Prospera in Honduras have a 5% tax rate and are based on decentralization and bitcoin-based capital. -

Social media sites like Substack and Twitter (X) have integrated Bitcoin’s Lightning Network as a means of payment. Paxful also accepts Lightning Network payments, as does McDonalds’ and Walmart.

In terms of on-chain metrics, active wallet addresses are nearing all-time highs, and the price is widely expected to hit

Attitude is Everything

An uplifting idiom that is often heard among BTC proponents is to “stay humble, stack satoshis”. This is the needed attitude to have, not mindless profit-taking driven by 100x returns and a mindless meme frenzy. It’s about financial equality and the creation of a new economy built on trust, transparency, and liberty, the polar opposite of the existing fiat ecosystem.

With L2s like Rootstock, LW, and Stacks rendering moot most prior criticisms of Bitcoin, we are all set to take back the financial economy through the only crypto that has ever mattered: Bitcoin

Business owners should be encouraged, across the world, to do their part and accept BTC for payment. Not as a means of taking profits on Bitcoin holding, but so it becomes an accepted norm for payment transactions. This will lead to liberated financial markets, known as

Despite decades of propaganda, the truth is that Bitcoin is the PERFECT solution to a broken financial system and the only thing needed is usage and adoption. It’s low-cost, scalable, fast, and iconic. It’s also more than capable of handling large transaction volumes and will help to alleviate a world under siege by inept politicians and corrupt central banks.

The rate of Bitcoin adoption across the globe might be the best metric we have to measure individual liberties.